Automating Weather Data Pipelines: A Data-Driven Approach

Weather variability plays a critical role in the insurance sector, influencing risk assessment, policy pricing, and claim settlements. Whether it is property insurance or agricultural insurance, access to accurate and timely weather data is essential for insurers to make informed decisions. However, manually handling vast amounts of weather data from sources like the Indian Meteorological Department (IMD) and ERA5 is inefficient and error-prone.

Automating the weather data pipeline ensures seamless data acquisition, processing, and storage, enabling insurance companies to enhance their risk models, streamline claims validation, and optimize policy structures. This blog explores how leveraging automation tools like Luigi, Pandas, and PostgreSQL can transform weather data processing for insurance applications.

Why Automate Weather Data Processing?

Insurance decisions depend heavily on weather data, making automation essential for:

- Real-time data availability: Ensuring that weather data is always up-to-date.

- Error reduction: Eliminating manual intervention minimizes the risk of inconsistencies.

- Scalability: Handling large datasets efficiently without performance bottlenecks.

- Seamless integration with analytics: Supporting risk assessment, policy optimization, and predictive modeling.

By automating weather data processing, insurers can enhance underwriting models, create dynamic pricing strategies, and validate claims with precision, ultimately improving customer satisfaction and financial performance.

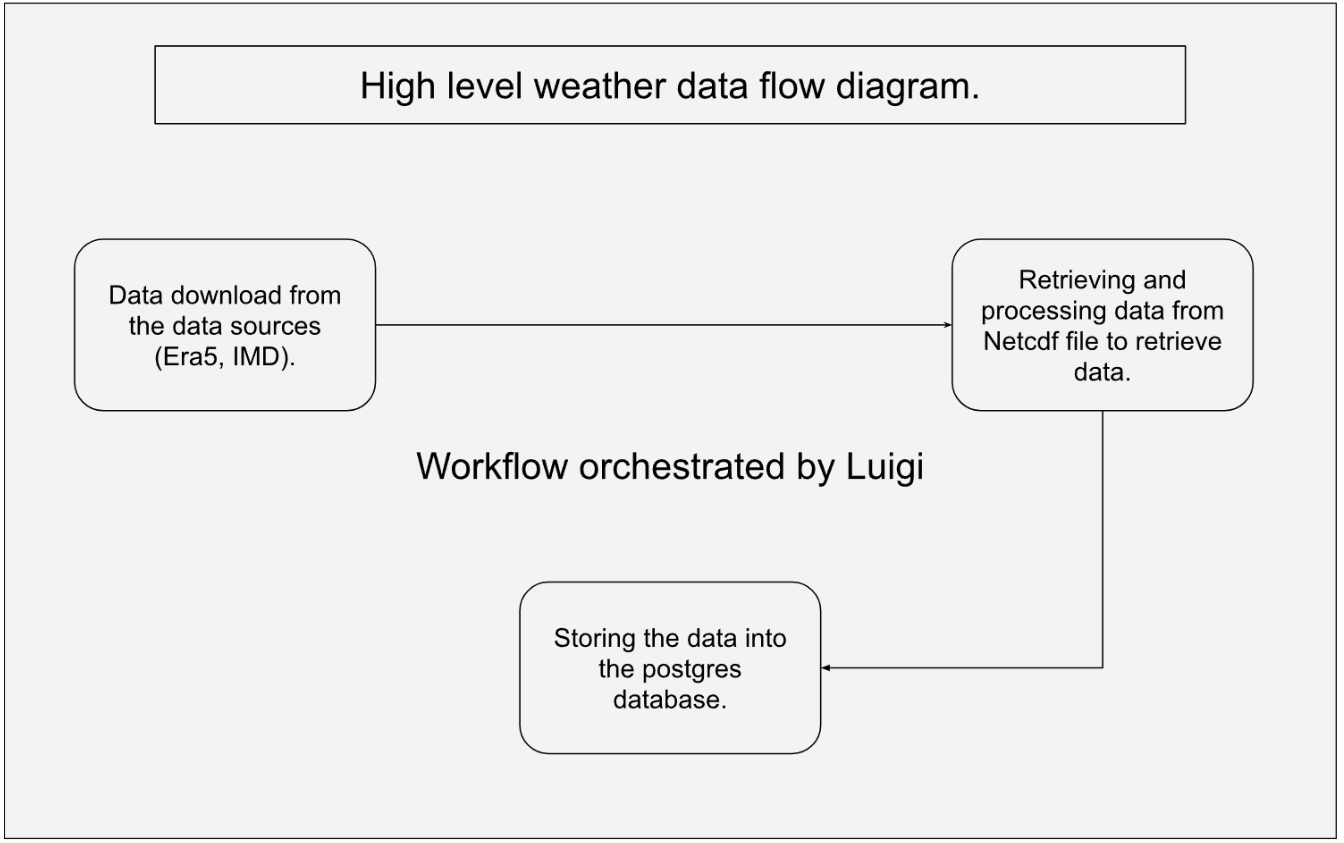

Key Components of an Automated Weather Data Pipeline

A robust weather data pipeline consists of four essential stages:

1. Automated Data Acquisition

Weather data from IMD and ERA5 provides insights into extreme weather patterns, precipitation anomalies, temperature trends, and drought conditions. Automating data acquisition ensures:

- Scheduled retrieval of NetCDF files using scripted download mechanisms.

- Efficient handling of large datasets through parallelized downloads.

- Error handling and retry mechanisms for reliable data ingestion.

- Metadata tracking for version control and data lineage.

2. Processing Weather Data from NetCDF Files

Once downloaded, NetCDF files must be transformed into structured formats for analysis. This involves:

- Reading NetCDF files and extract relevant weather attributes like temperature, precipitation, and wind speed.

- Handling missing values and standardizing data formats using Pandas.

- Interpolating data for locations where direct measurements are unavailable, ensuring comprehensive coverage for insurance assessments.

- Converting data into tabular format for efficient storage and retrieval.

3. Storing Data in PostgreSQL with PostGIS

Processed weather data is stored in a PostgreSQL database, enhanced with PostGIS for spatial analysis. This ensures:

- Efficient querying and historical trend analysis.

- Linking weather data with insurance policy zones for localized insights.

- Secure access for risk assessment and claims validation teams.

4. Workflow Orchestration with Luigi

Luigi automates and manages the end-to-end workflow of weather data processing, ensuring:

- Seamless task dependencies between data acquisition, processing, and storage.

- Scheduled execution for continuous weather monitoring.

- Logging and error tracking for enhanced reliability.

Conclusion

The insurance industry stands at a critical juncture where technology and risk management converge. By automating weather data pipelines using Pandas, Luigi, and PostgreSQL, insurers gain real-time insights into climate risks, enabling smarter underwriting, more accurate pricing, and efficient claims processing.

Investing in automated weather data solutions is not just a technological upgrade—it is a strategic necessity for competitive and resilient insurance operations. With climate patterns becoming increasingly unpredictable, insurers that harness data-driven decision-making will lead the industry in offering fair, timely, and robust coverage.

By transforming weather data into a strategic asset, insurance companies can mitigate risk, enhance profitability, and build a more resilient financial ecosystem for policyholders and stakeholders alike.